Historic Window Restoration

2023 Residential Tax Credit

Learn how this Historic Uptown property owner applied successfully for a 20% residential tax credit for their historic window restoration project.

Project Timeline

April 2023-June 2023

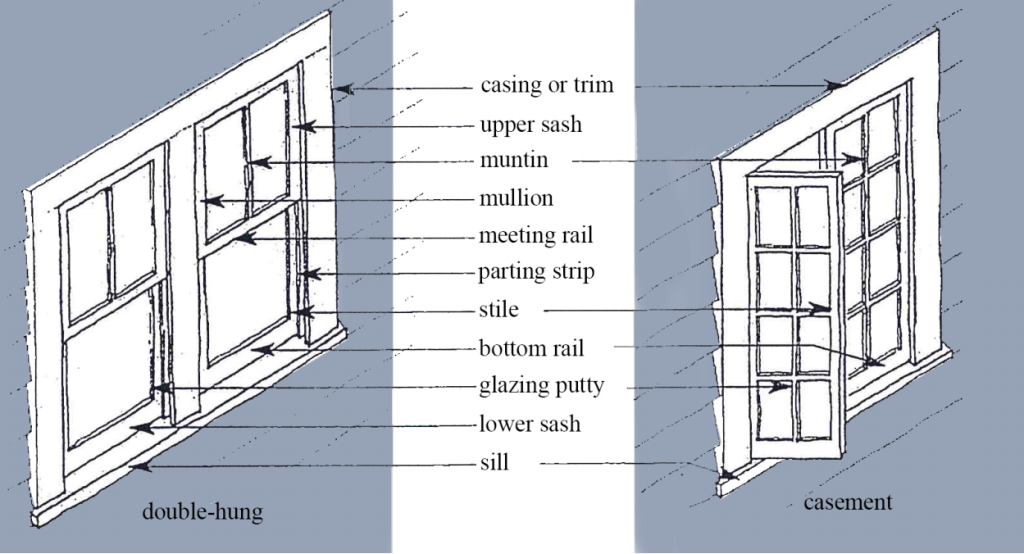

The property owner obtained quotes from four contractors to restore the original 18 sash windows, 1 casement window, and 1 transom window.

The property owner decided to proceed with the quote Deep Roots Craftsman provided. The owner proceeded with only restoring the 6 upstairs windows due to costs. The predicted cost of fully restoring the 5 double-hung sash windows and 1 casement window, and building custom screens was quoted as $21,060.

August 2023

August 10-11, Deep Roots Craftsman pulled the 6 upstairs windows to take them to their shop in Denver for restoration.

On August 10, the property owner mailed in their Part 1 Tax Credit application and a $250 money order to History Colorado at 1200 Broadway, Denver, CO 80203. See their completed Part 1 application below.

October 2023

On October 24, the property owner was notified by History Colorado via email that their Part 1 tax credit application was approved.

October 25-26, Deep Roots Craftsman returned to install the restored windows and complete onsite work that included removing paint, and repairing and constructing casement parts. It was determined that Deep Roots Craftsman would need to return for further onsite work at a later date.

November 2023

November 16-18 Deep Roots Craftsman returned to complete additional onsite work. Onsite work included removing paint and varnish from window casings, and repairing and constructing window screen frames and case parts.

On November 30 Deep Roots Craftsman returned to complete the final onsite work which was to install the screens made by their manufacturer.

December 2023

On December 10, the property owners emailed Part 2 of their tax credit application to History Colorado. The property owners are awaiting word from History Colorado regarding the status of Part 2 of their application.

The total cost for the restoration of 6 windows on the upper level was $29,553.36.

January 2024

On January 8, the property owners received via email a form titled Verification of Qualified Nature of Expenditures for Preservation of Historic Structures Residential 2014 Credit to be filed with their state tax return.

The tax credit granted was $7,388, which was larger than the expected amount of $5,910.68.

Tax Credit Breakdown

$29,553.36

Window Restoration Project Cost

$250

Tax Credit Application Fee

$7,388

State Tax Credit Received

Window Restoration Results

The property owner found that restoring their historical windows offered several compelling benefits. Here are some of the reasons why the property owners chose to restore rather than replace:

- Preservation of Character and Architectural Integrity: The original windows contributed to the historical authenticity and character of the property. Restoring the windows helped to preserve the unique features and craftsmanship that are often difficult to replicate with modern materials.

- Aesthetic Appeal and Unique Design: Historical windows were designed with specific architectural styles in mind. Restoring them allowed the property owners to maintain the original aesthetic appeal of their home, contributing to its overall charm and beauty.

- Cultural and Historical Significance, and Heritage Value: Historical windows were part of a building’s history. Preserving the windows honors the heritage of the property and contributes to the cultural significance of the surrounding community.

- Environmental Considerations and Sustainability: Restoring the existing windows was more environmentally friendly than manufacturing new windows. It reduced the demand for resources and minimized the environmental impact associated with the production and disposal of materials.

- Cost-Effectiveness and Long-Term Savings: While the initial cost of restoration was comparable to replacement, the long-term savings were more significant. Well-maintained historic windows can have a long lifespan of 100+ years. While new windows have a lifespan average of 20+ years.

- Energy Efficiency and Upgrades: Historic windows can be upgraded to improve energy efficiency without compromising their original character. Measures such as adding storm windows, weatherstripping, or applying new glazing can enhance insulation.

- Quality Materials and Durability: The original windows were crafted from high-quality materials like old-growth wood. When properly maintained, the restored windows will withstand the test of time better than some modern alternatives.

- Local Regulations and Preservation Guidelines: The Weber-Wahsatch Historic District has regulations in place to protect historical properties. Restoring existing windows is the preferred option to comply with local preservation guidelines.

- Customization and Tailored Solutions: Restoration allowed for customization based on the specific needs of the windows and home. The property owner worked with Deep Roots Craftsman to address issues such as drafts, operational difficulties, and replacement pieces while preserving the historical integrity of the windows.

- Curb Appeal, Property Value, and Positive Impact: Preserving original features, including historical windows, can positively impact the curb appeal of the property. Additionally, maintaining historical elements may contribute to the overall resale value of the property.

- Personal and Historical Connections: Restoring historical features creates a personal connection to the past and the individuals who lived in or designed the property. It has been a gratifying experience to contribute to the ongoing legacy of the property.

Leave a comment