Historic Preservation Tax Credits

Residential and commercial building income tax credits available for historic rehabilitation are designed to encourage the renovation and re-use of older buildings.

We have created this resource to assist those who wish to apply for the tax credits.

Tax Credit Window Restoration – read about how a historic residence property owner in Historic Uptown successfully applied for a 20% tax credit for window restoration.

Table of Contents

State Residential Historic Preservation Tax Credits

Historic Preservation Tax Credits are one type of preservation incentive available to private resident property owners in the state of Colorado. They are a dollar-for-dollar reduction towards a state income tax liability. They can be applied for on any type of residential home as long as it is a private residence.

Colorado offers a state income tax credit to property owners for preservation and rehabilitation work on designated historic properties. For commercial (income-producing) projects, visit the Colorado Office of Economic Development and International Trade website for information and application details.

For residential projects, History Colorado reviews and certifies state income tax credit applications. Owners are advised to get appropriate tax advice to ensure all requirements are met.

The tax credit for residential, producing projects is 20-35% of the qualified rehabilitation costs dependent upon location. A maximum of $100,000 tax credit credit per qualified property is allowed every ten years.

Do you have a project that is a good fit for the tax credits?

Designated

Is your building designated at the local, state, or national level? Does it have the potential to be?

Ownership

Is the building privately owned?

Minimum Spending

Are you spending at least $5,000 in eligible costs?

Work Plan

Have you already started work? Are you getting ready to begin?

Carryover with Owner

The credit stays with the owner even if they move. You have 10 years to use the credit.

Administering Tax Credits

Colorado Springs is a History Colorado Certified Local Government that used to directly administer Colorado Homeowner Tax Credits through the Colorado Springs Planning Department from 1995 to 2009.

There is no longer local administration of the tax credit program and homeowners must work directly with History Colorado to apply for tax credits. When Colorado Springs locally administered tax credits, over $1,014,700 in tax credits were granted to Colorado Springs Homeowners from 1995 to 2009. This was almost 30 years ago! Today, few homeowners apply due to a lack of local support and guidance. Please contact your local City Council Representative to request bringing back local administration of this program!

Residential Tax Credit Eligibility

Requirements

- Properties must be at least 30 years old and meet at least one of the below criteria:

- Listed on the National Register of Historic Places or a contributing property in a historic district listed on the National Register.

- Listed on the Colorado Register of Historic Properties or a contributing property in a historic district listed on the Colorado Register.

- Designated by the Colorado Springs City Council as a local Historic Preservation Overlay Zone.

- Applicants must be owner-occupants of the property, owners that do not earn income from the property, or tenants with leases of five or more years. Applicants must also have taxable Colorado income.

- Projects must involve physical preservation, restoration, or rehabilitation of historic buildings. A project can include multiple work items.

- Eligible work can only include what is listed in the below “Qualified Expenses” section. If the type of work is not listed there, it is not eligible for tax credits. However, all work undertaken during the project must be listed in the application, whether it is eligible for tax credits or not. History Colorado staff can also help applicants determine if work items are eligible.

- Projects must preserve the historic character of the property and the entire project, including non-eligible work, must meet the Secretary of the Interior’s Standards for Rehabilitation. History Colorado will review the application to ensure that these standards are met.

- Rehabilitation costs must be over $5,000. Applicants may reach the $5,000 minimum through one work item or multiple work items.

- If the project is Historic Preservation Zoned, all exterior work that requires a building or zoning permit must be approved by the Historic Preservation Board Report of Acceptability.

- Applicants are highly encouraged to apply before they begin working on their property. While the tax credit rules allow applicants to submit a tax credit application within 24 months from the start of the project, submitting an application does not guarantee approval of the tax credit. By submitting an application after work has begun, applicants run the risk of being denied if program requirements are not met.

Qualified Expenses

The following work items qualify for the residential tax credit. If an item is not on this list, it does not qualify for the tax credit. For a project to be eligible for a tax credit, all work including interior work, exterior work, and qualified and non-qualified expenses must conform to the Secretary of the Interior’s Standards for Rehabilitation as determined by History Colorado.

| Masonry – repair, repointing, or replacement (as required*) | Qualified Interior Work |

|---|---|

| Interior historic walls and finishes, woodwork and trim – repairs and replacement (as required*) | Interior historic walls and finishes, wood work and trim – repairs and replacement (as required*) |

| Siding, woodwork and trim – repair or replacement (as required*) | Historic floor materials (except carpet) – repairs, refinishing, and replacement (as required*) |

| Foundation repairs or replacement – including associated excavation work | Reconstruction of missing interior historic elements – when sufficiently documented |

| Roofs – repair or replacement (as required*) | Electrical, plumbing, heating, ventilation & air conditioning – repairs and upgrades |

| Windows and doors – repair or replacement (as required*) | Insulation |

| All construction work that is directly associated with the above work items is also qualified. *Replacement of historic features may be a qualified expense if it is clearly demonstrated that the features are in irreparable condition. Replacement elements must match the historic features in size, shape, configuration, material, and appearance. | |

Expenses that do not qualify for the tax credit include, but are not limited to:

- Rehabilitation of additions or accessory structures that were constructed outside the period of significance for the property or historic district

- Expenses for remodeling bathrooms or kitchens except for rehabilitation of historic features

- Changes to historic interior floor plans

- Finishing of basements

- Fixtures and appliances

- Landscaping, fences, retaining walls, or other site work

- Site excavation (including basements), grading and paving

- Replacement of sewer lines

- Permit and inspection fees

- Acquisition costs

- Architecture, engineering, or design fees

- “Soft costs” such as appraisals, legal fees, accounting, realtor fees, and insurance

Completing the Project

There is no deadline to complete the project, but the Part 2 application must be submitted within 120 days of completion of the project.

FAQs

Residential Tax Credit

Application

How do I apply?

Applicants who own an owner-occupied property will apply through History Colorado.

Applicants who own an income-producing property must apply for a commercial tax credit through Colorado’s Office of Economic Development and International Trade.

Are there fees for review?

Yes. The amount of the fee depends on the total estimated project costs, which may be higher than the qualifying costs associated with the project. If the total estimated project cost is:

- $15,000 or less the fee is $250

- $15,001 to $50,000 the fee is $500

- $50,001 to $100,000 the fee is $750

- For over $100,000 the fee is $1000

The fee is assessed when the Part 1 application is submitted. However, History Colorado will review the Part 1 application before charging the fee. Staff will let applicants know if they do not believe the project qualifies for the tax credit, and applicants will not be charged for the preliminary review.

How long does the review process take?

Tax credit applications are made in two parts. History Colorado reviews each part of the tax credit application to assess whether it meets the program’s eligibility requirements. For each part of the application, this review may take up to 90 days. The applicant has up to an additional 90 days to submit revised materials if requested by staff.

What do I need to submit?

The application is made in two parts. The Part 1 application shows the existing conditions before rehabilitation work, describes the proposed scope of work for the entire project (including qualifying and non-qualifying work), and provides cost estimates for the proposed work. If the project includes work that qualifies for the tax credit as well as non-qualifying work, applicants must submit a detailed budget that clearly identifies qualifying and non-qualifying expenses.

Photographs of the areas of work, both interior and exterior, showing the condition before rehabilitation must be included with the Part 1 application. If any interior demolition is planned as part of the project, complete floor plans showing existing conditions and proposed conditions must be submitted with all proposed interior demolition clearly indicated.

If any of the proposed work requires Historic Preservation Board review, the Historic Preservation Board must issue a report of acceptability and stamped approved drawings before the Part 1 application may be certified by History Colorado.

Note that the Historic Preservation Board Report of Acceptability does not guarantee approval of tax credits. Tax credits are reviewed based on the Secretary of the Interior’s Standards for Rehabilitation, the tax credit statutes, and rules and regulations.

The Part 2 application shows the completed work and a final budget with corresponding, itemized invoices for the completed work. Photographs must also be included with the Part 2 application that shows all areas of completed work. Ideally, the Part 2 photographs should replicate those submitted with the Part 1 application as closely as possible to clearly show before and after conditions.

Are there timelines for submittal of the Part 1 or Part 2 applications?

Yes. Applicants are strongly encouraged to submit their Part 1 application before they begin work. However, the Part 1 application may be submitted after the project has already started if the Part 1 application is submitted within 24 months of the start of the project. There is no limit to the timeframe for the completion of a project after submitting Part 1. The Part 2 application must be submitted within 120 days of completion of the project. These timelines are inflexible and are outlined in the tax credit rules and regulations.

When is a project deemed complete?

A project is considered complete after the applicant makes the final payment on the contractor’s invoices, or when the final inspection is approved by Community Planning and Development if a building or zoning permit and subsequent inspection are required.

Can I submit an application while the project is under construction or after I complete the work?

Yes, but applicants do so with a substantial risk that the project is ineligible for tax credits or the tax credit application is incomplete and cannot be approved.

History Colorado has found that many Part 1 applications submitted after the completion of the project often lack comprehensive photographs of the existing condition before the start of the project, which disqualifies the application.

History Colorado has also found that the completed work shown in the Part 2 applications does not always meet the Secretary of the Interior’s Standards for Rehabilitation, which also disqualifies the application.

In addition, all work on the property undertaken simultaneously must be included in the tax credit application, including qualifying and non-qualifying work. All work must meet the Secretary of the Interior’s Standards for Rehabilitation regardless of whether it qualifies for tax credits. Finally, there are strict timelines outlined in the state’s rules and regulations governing the tax credit program, as mentioned above.

The Part 1 application may not be submitted more than 24 months after the start of the rehabilitation project. The Part 2 application may not be submitted more than 120 days after the completion of the project. Due to the complexities of tax credit applications, History Colorado strongly encourages applicants to submit their Part 1 application before beginning any work.

Is there a minimum amount of work to qualify for the tax credit?

Yes, applicants must propose and complete at least $5,000 of qualified rehabilitation expenses on their property to qualify for the tax credit.

Get Help

Any questions about the application, eligibility requirements, and what may or may not qualify for tax credits can be sent to History Colorado.

More Information

State Tax Credits

Visit the History Colorado website to learn more about how to apply for state tax credits for residential and income-producing properties.

2023 Tax Credit Window Restoration – read about how a historic residence property owner in Historic Uptown successfully applied for a 20% tax credit for window restoration.

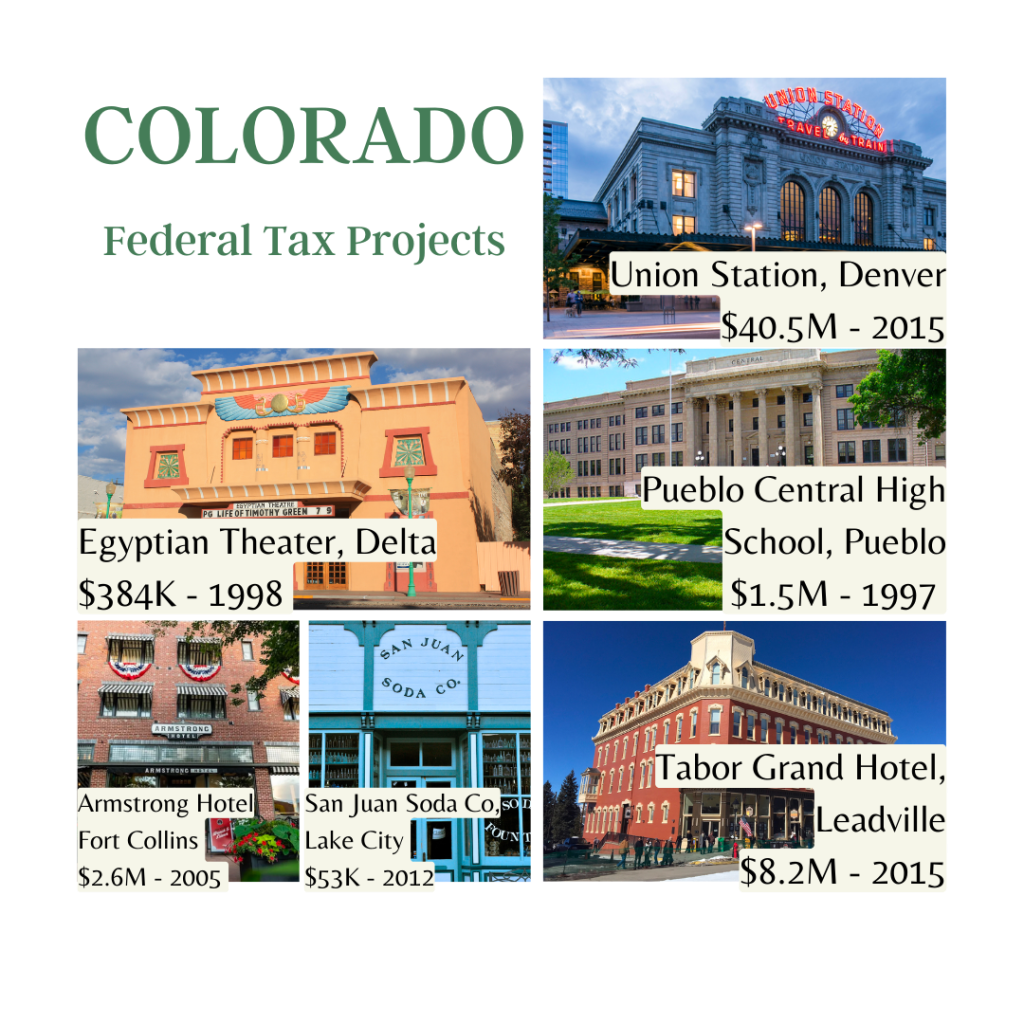

Federal Tax Credits

Visit the National Park Service website to learn more about how to apply for federal tax credits for income-producing properties.